Frequently Asked Questions

Insurance authentication and monitoring is a tricky problem to tackle. We’ve answered some of your most frequently asked questions here, but reach out if you don’t find the information you need.

All About Modives

What is Modives?

Modives is the only solution that makes the end-to-end process of insurance authentication, monitoring, and providing access to coverage options easy with its simple and automated solution.

How do you pronounce Modives?

How does it work?

When you want to initiate insurance authentication for your resident, renter, or buyer, it’s easy to kick off the process through Modives’ patent-pending process.

Click here to learn about our process for Auto Dealerships, Property Management and Property Owner-Landlords.

How do you keep my customer's information private?

Our process is SOC 2 certified and uses 256-bit AES encryption for data at rest, providing a high level of protection against unauthorized access. For data in transit, we utilize TLS 1.3 or higher, which ensures that the data exchanged over networks is securely encrypted and protected from interception.

Who uses Modives?

Modives is built for any property- or auto-related business in which uninsured or underinsured customer risk poses a threat. Through its patent-pending process, Modives ensures the protection you expect your customer to carry through insurances is both active and adequate.

Modives’ system can be implemented for any property- or auto-related business, including car sales, apartment or home rentals, car rentals or loaners, storage units, and others.

How can I learn more?

How can my business use the Modives solutions?

CheckMy Driver and CheckMy Resident are available at two integration levels:

- Web app: Log into our online solution to update your information, send verification requests, view your results, and more.

- API: Integrate our solution into your own application. Learn more on our integrations page.

Can I white-label any of your solutions?

Yes, all of our solutions are available for white-labeling. Schedule a demo for CheckMy Resident or CheckMy Driver to learn more.

for Property Rentals

What is CheckMy Resident?

Your renters’ insurance only covers you if it’s active, accurate, and adequate. Through CheckMy Resident, Modives makes insurance authentication and monitoring easy so you get the transparency into your resident’s policy you need to protect your business, your liability, and your peace of mind.

How does CheckMy Resident for property rentals work?

To learn more about CheckMy Resident for Property Management, click here.

Why do I need renters insurance monitoring?

Once you verify your tenant’s insurance, you have no way of knowing whether it’s still active. Renters can cancel or reduce their insurance coverage at any time, even after initial checks, removing the protection you're depending upon for your resident.

In fact, studies show that 45% of renters' insurance policies cancel within the term of their lease, and 19.5% cancel within the first 180 days.

Insurance monitoring solutions verify that your resident’s insurance is active and adequate, alerting you if their insurance falls out of compliance.

How does CheckMy Resident retrieve my customer's data?

We connect with 250+ insurance carriers to automatically retrieve policy information from tenants in real time. From there, our AI-powered engine reviews the data to verify whether the policy is active, accurate, and adequate. Finally, it sends an easy-to-read results page to you and your resident.

How long does it take CheckMy Resident to get up and running?

With our self-serve web app, you can create your CheckMy Resident account and start verifying your renters’ insurance in as little as a few minutes. For enterprise-level accounts, our team will set up your solution for you.there, our AI-powered engine reviews the data to verify whether the policy is active, accurate, and adequate. Finally, it sends an easy-to-read results page to you and your resident.

How much does CheckMy Resident cost?

There are no upfront or ongoing membership fees for CheckMy Resident. Pricing is calculated on a per-credit basis with volume discounts.

What if my tenant doesn’t have active or adequate insurance at the time of verification?

If your tenant doesn’t have renters’ insurance, or if their policy is insufficient, our solution includes embedded insurance options to let them buy affordable and easy-to-purchase coverage on the spot.

What if my tenant doesn't remember their insurance login credentials?

As part of your tenant's onboarding, we'll send them a link to confirm that they can access their credentials.

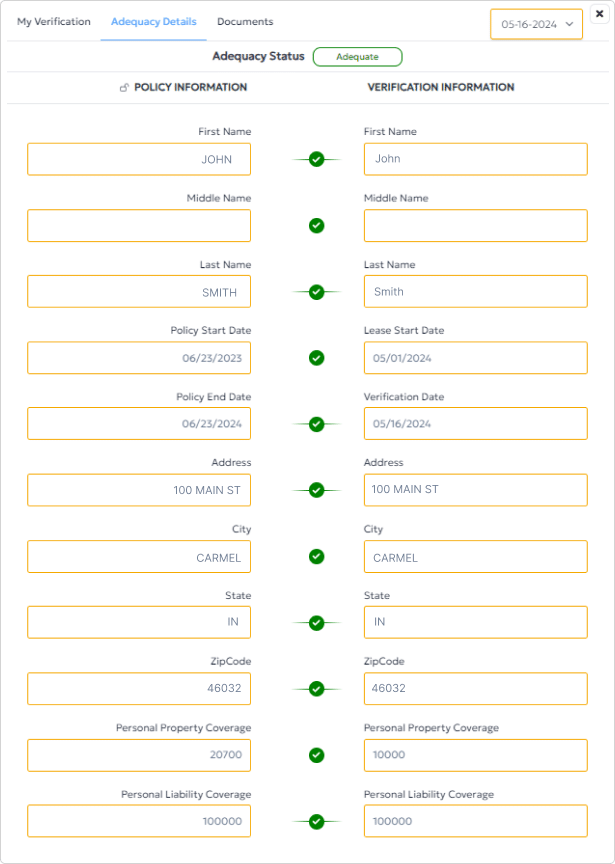

What does the verification results page look like?

The verification page includes an easy-to-read report confirming whether your tenant’s policy is active, accurate, and adequate.

Do I have to download an app to use CheckMy Resident?

No, you can access CheckMy Resident online through our cloud-based application.

for Auto Transactions

What is CheckMy Driver?

Insurance that is active and adequate to your state’s requirements must be in place before a car leaves your lot, but the insurance checking process is manual, time-consuming and aggravating. After devoting time on the phone to verify insurance with a carrier, your sale could be in jeopardy if your customer alters their policy.

With CheckMy Driver, Modives simplifies and automates the insurance authentication process, saving you time and reducing your compliance exposure through Modives’ patent-pending, consumer-driven process. Determine whether your buyer’s insurance is active and adequate earlier in the process to save you time and lost sales down the line.

How does CheckMy Driver for car dealerships work?

To learn more about CheckMy Resident for Auto Dealerships, click here.

Why do I need auto insurance monitoring?

For Buy Here Pay Here car dealers, confirming your customers have sufficient insurance is critical to protecting your business until the vehicle is paid off. After initial verification, your customer could cancel their policy, leaving you open to unexpected costs in the event of an accident.Insurance monitoring solutions verify that your resident’s insurance is active and adequate, alerting you if their insurance falls out of compliance.

How does CheckMy Driver retrieve my customer's data?

We connect with 250+ insurance carriers to automatically retrieve policy information from drivers in real time. From there, our AI-powered engine reviews the data to verify whether the policy is active, accurate, and adequate. Finally, it sends an easy-to-read results page to you and your customer.

How long does it take CheckMy Driver to get up and running?

With our self-serve web app, you can create your CheckMy Driver account and start verifying your renters’ insurance in as little as a few minutes. For enterprise-level accounts, our team will set up your solution for you.

How much does CheckMy Driver cost?

There are no upfront or ongoing membership fees for CheckMy Driver. Pricing is calculated on a per-credit basis with volume discounts.

What if my customer doesn’t have active or adequate insurance at the time of verification?

If your customer doesn’t have auto insurance, or if their policy is insufficient, our solution includes embedded insurance options to let them buy affordable and easy-to-purchase coverage on the spot.

What if my customer doesn't remember their insurance login credentials?

As part of your customer's onboarding, we'll send them a link to confirm that they can access their credentials.

What does the verification results page look like?

The verification page includes an easy-to-read report confirming whether your tenant’s policy is active, accurate, and adequate. Check out an example report here.

How long does it take to get the data results?

Once your customer logs in to their insurance account, it takes 5.6 seconds to transfer policy data from the carrier to CheckMy Driver.

Do I have to download an app to use CheckMy Driver?

No, you can access CheckMy Driver online through our cloud-based application.

Want to Learn More?

Schedule a demo today to learn how Modives can help your risk protection live up to its promise.