Want to learn more about

CheckMy Driver?

Connect to find out how CheckMy Driver can help you:

- Create a better experience for your customers, improving their satisfaction an estimated 12 points

- Save more than 15 minutes during each sale by automating your insurance verification process

- Eliminate FTC Safeguard compliance violations and the hefty fines at risk because of them.

Get More Information!

Traditional Insurance Verification is Broken

Time Consuming

You waste time on hold with insurance carriers, analyzing coverage documents or data, and waiting on next steps.

Bad Customer Experience

24% of consumers identified waiting on F&I as one of the most troublesome tasks during the car buying process.

Compliance Violations

The FTC is cracking down on dealerships that don’t protect consumer data, serving massive fines.

Here’s What People Are Saying About Modives

“It saves me, honestly, my week. Once it’s running and connects everyone, I don’t have to waste time spending the rest of my week checking insurance. Instead, I can focus on new business.”

Ciara Fondren, Elite Auto

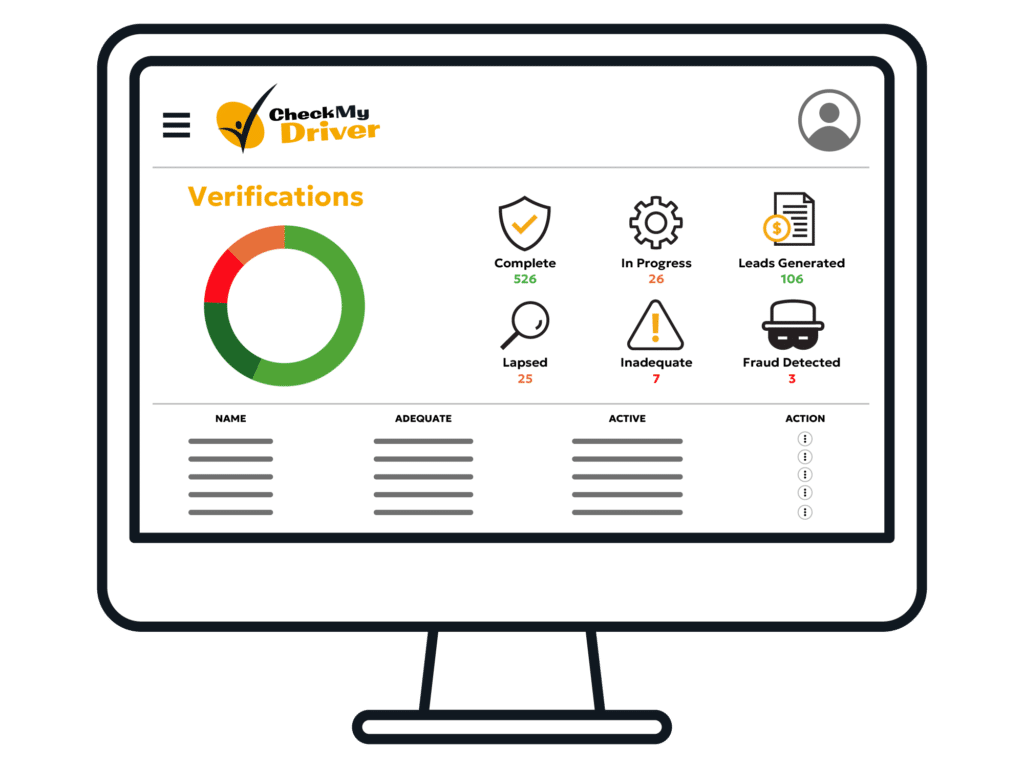

We Fix The Broken Insurance Verification Process

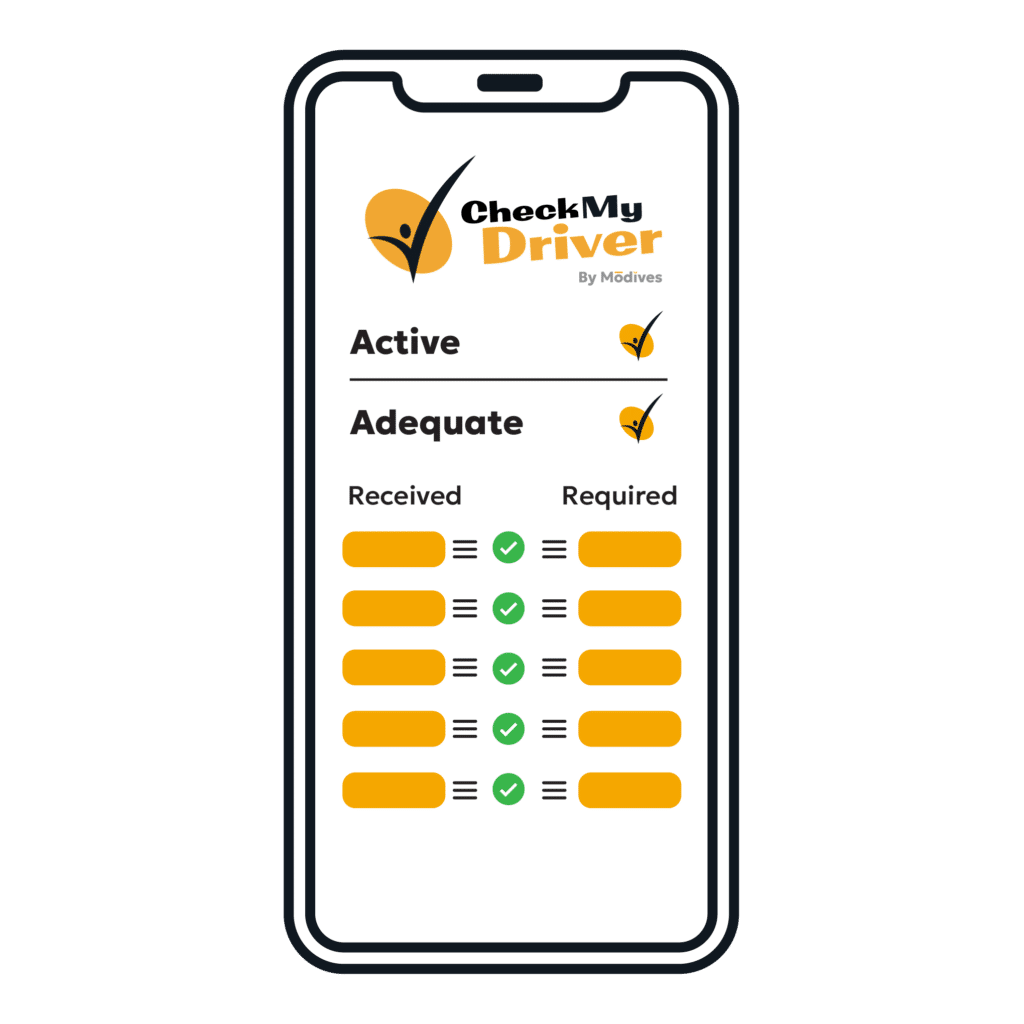

Carrier-Confirmed Coverage

CheckMy Driver verifies your customers’ coverage in real time through its simple consumer-driven process.

Insurance Expert Analysis

Skip manually reviewing coverages to make sure they meet requirements. Our decades of insurance expertise are at work through our AI-driven adequacy engine to give you actionable and easily interpreted results.

Consumer Data Protection

No need to worry about complying with FTC Safeguards guidelines, CheckMy Driver protects your customers’ data with encryption in transit and at rest.

Run Anytime

Pre-qualify your shopper and cover your assets during test drive, verify to complete the sale or lease, check change/add to transfer title, and monitor to protect your loan.

Eliminate Fraud

CheckMy ID safeguards your business against the estimated $7.9 billion in auto lender losses last year by combining ID scanning with insurance verification.

When to Use CheckMy Driver

- Test Drive - Don't let just anyone take your vehicle out for a test drive, know that they're covered before handing them keys.

- Sales/Lease - Close your sale by verifying that your buyer's insurance is active and adequate.

- Loaner and Rental - Know your vehicle is in good hands before you let someone take it for a drive.

- Policy Update - Remove your headaches, let Modives manage notifications and check updates to your buyer's policy.

Schedule a Demo Today

Learn how CheckMy Driver makes insurance verification and monitoring easy!

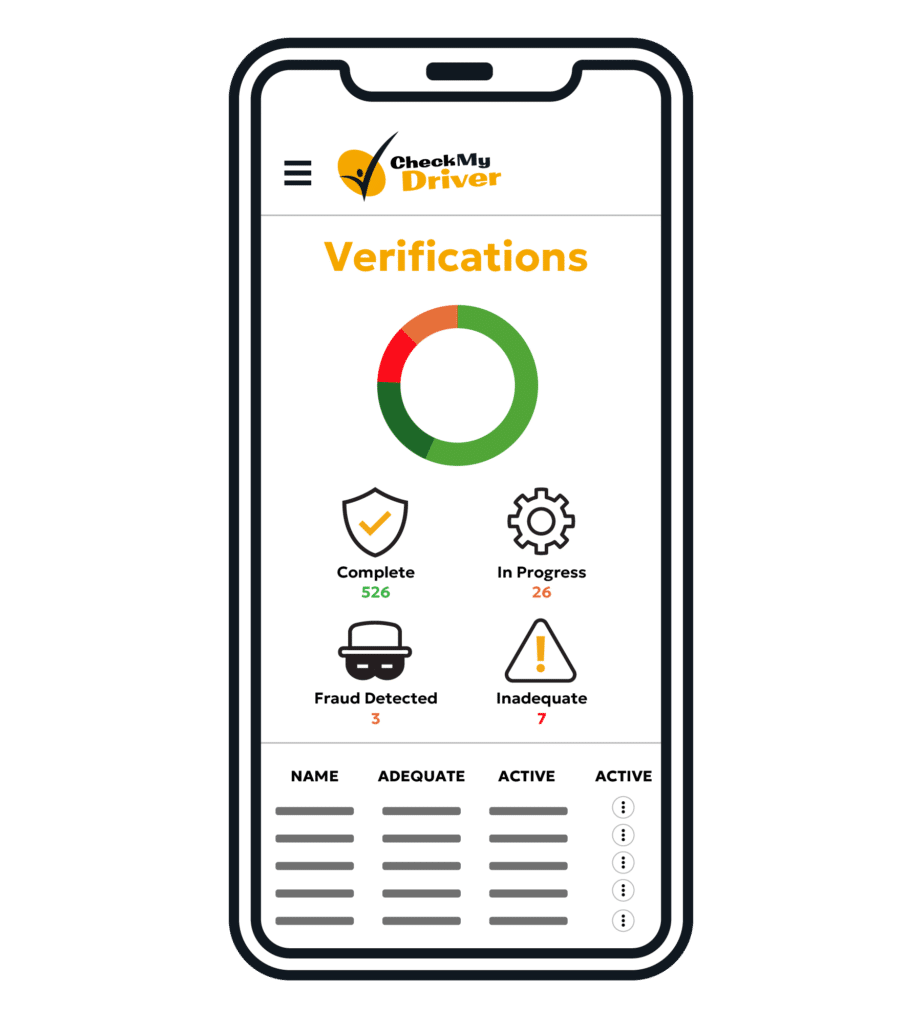

Features

Driver Insights

Learn more about your customer early in your sales process, including other drivers at home, their vehicles, and household data.

CheckMy ID

Detect and avoid fraud with the powerful combination of ID and insurance verification together during your transactions.

Adequacy Engine

Put decades of insurance expertise to work analyzing your customers’ coverage data, delivering actionable insights instantly.

Integration

Connect CheckMy Driver directly into your DMS or CRM, delivering key insights into your current tools to supercharge your process.

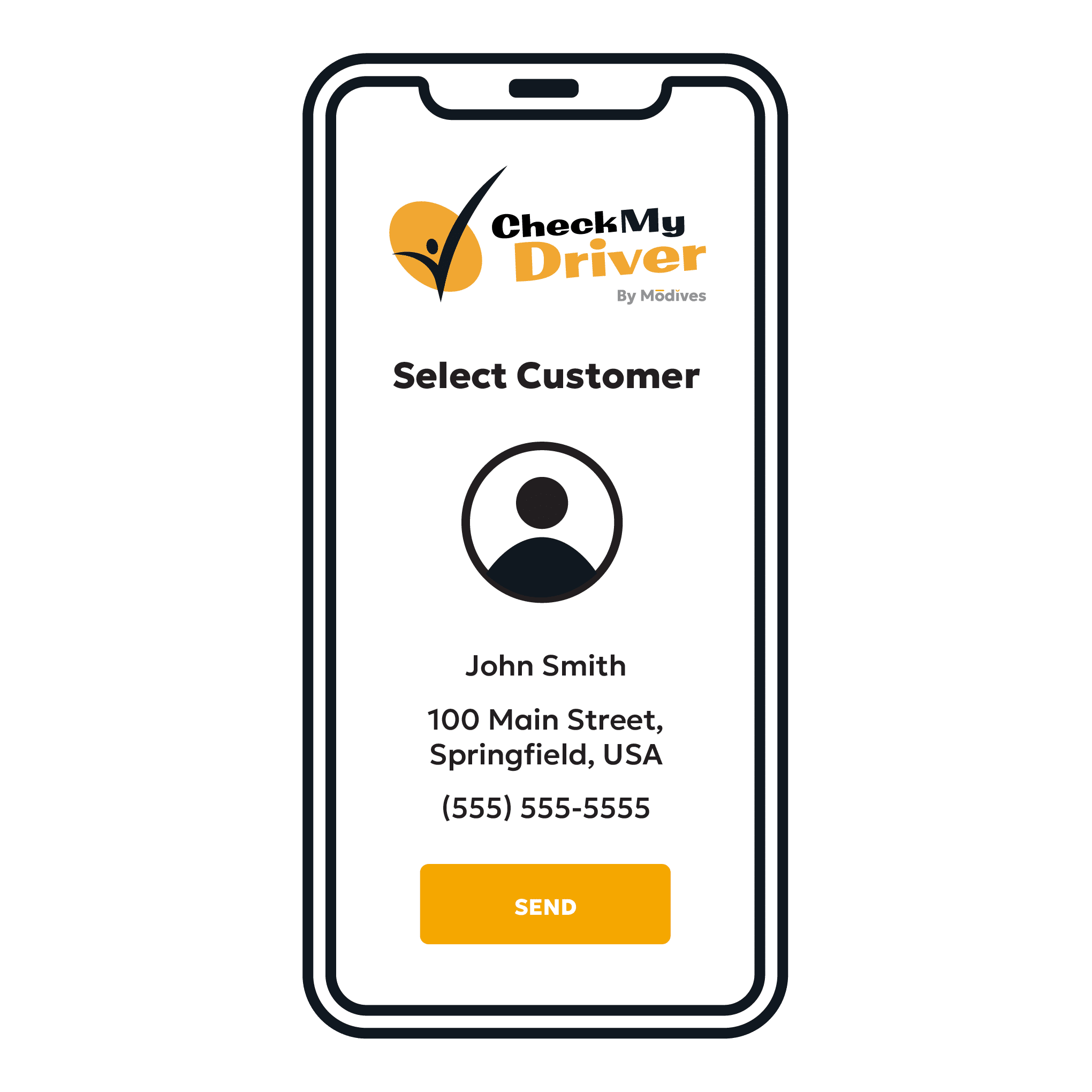

How It Works - As Easy As 1, 2, 3

Step 1

Trigger Verification for Your Customer

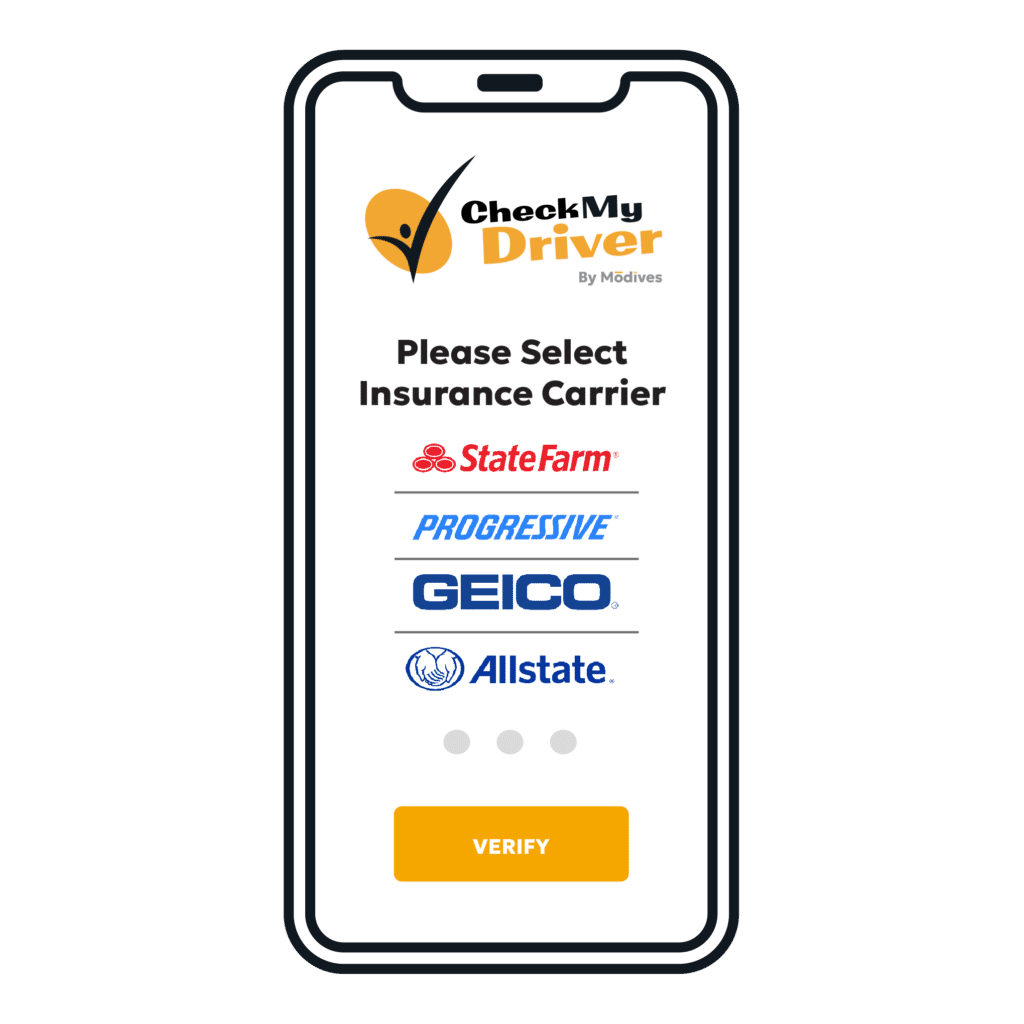

Step 2

Customer Signs In, Verifies Coverage

Embedded Insurance Options if Coverage Inactive or Inadequate

Step 3

You and Customer Receive Results

Step 4

Policy Monitored for Changes for Loaners and Short-Term Rentals