CheckMy Driver

For Auto Rentals

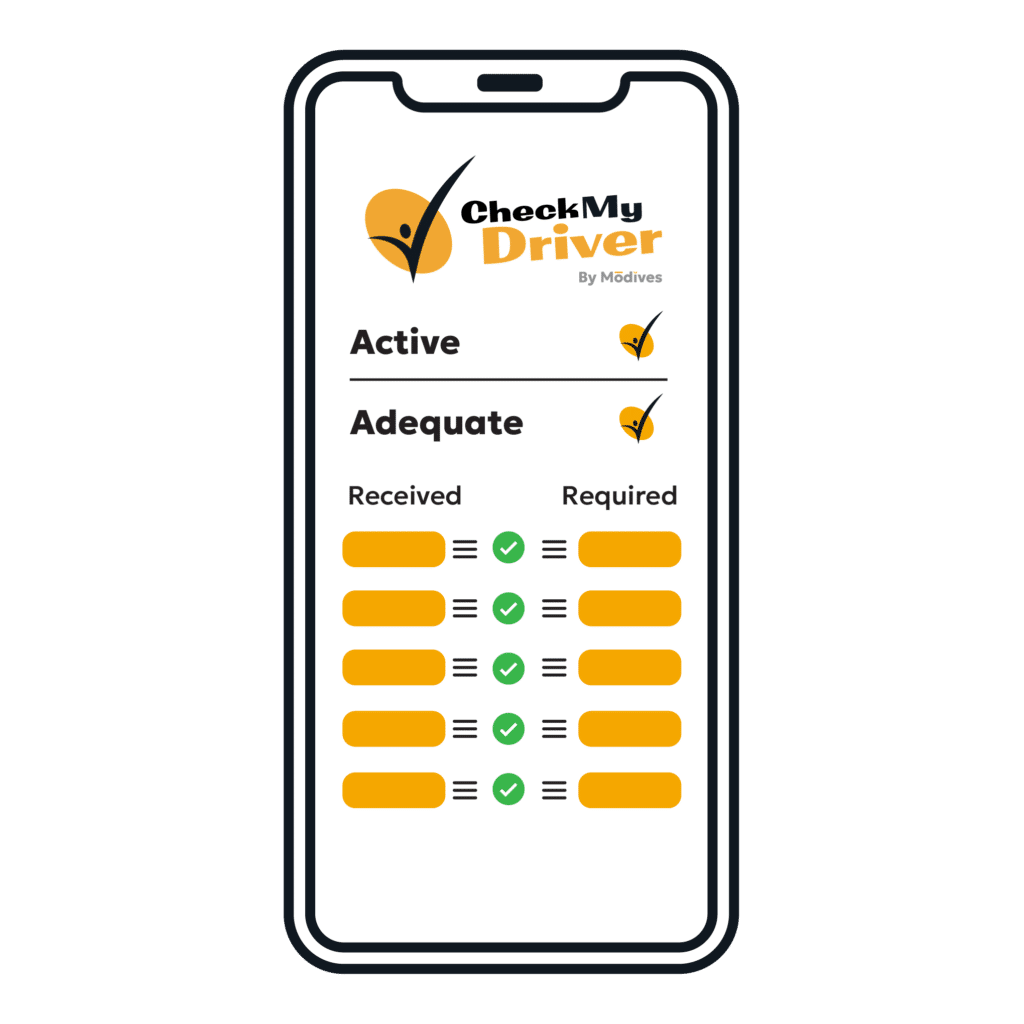

It’s vital that your drivers carry active, accurate, and adequate coverage during the term of their rental.

CheckMy Driver automates insurance verification and monitoring, checking to make sure your customers' coverage remains active and adequate throughout their rental.

14% of Drivers are Uninsured

With 51 million drivers on the road uninsured or underinsured, do you want to risk the loss of your asset or liability exposures for your rental? Know your driver is insured by verifying and monitoring their insurance during their rental.

Don’t Just Ask Whether They’re Insured

Verify Insurance to Protect and Support Your Business

Liability Risk

If your driver isn’t covered, not only is the value of your vehicle at risk, but you could also be liable for injuries in an incident.

Loss of Use

An accident that puts your vehicle in the shop also keeps it off the road. Make sure their coverage protects your losses.

Ancillary Income

If they aren’t protected, generate revenue by requiring they purchase coverage, either your own or through our embedded insurance.

How CheckMy Driver Protects Your Business

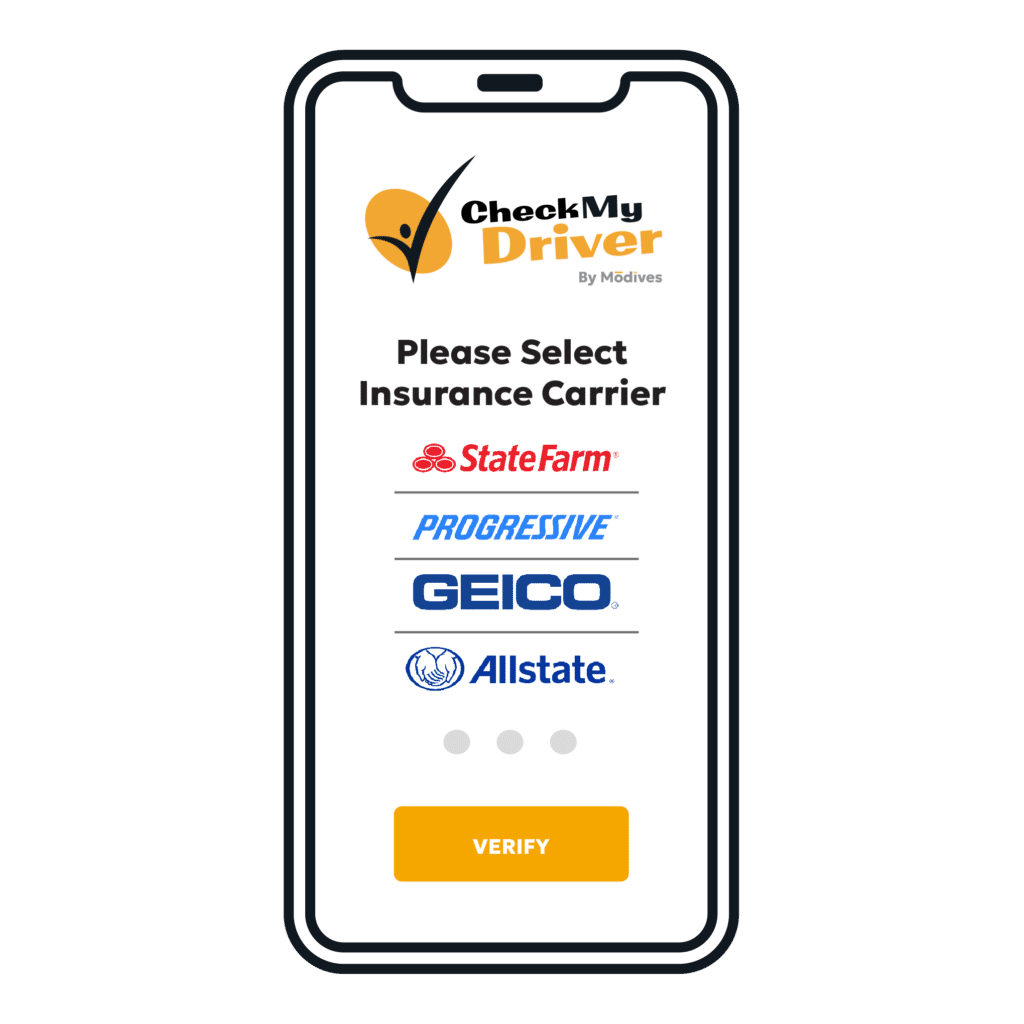

Carrier-Confirmed Coverage

CheckMy Driver verifies your customers’ coverage in real time through its simple consumer-driven process.

Insurance Expert Analysis

Skip manually reviewing coverages to make sure they meet requirements. Our decades of insurance expertise are at work through our AI-driven adequacy engine to give you actionable and easily interpreted results.

Consumer Data Protection

No need to worry about complying with FTC Safeguards guidelines, CheckMy Driver protects your customers’ data with encryption in transit and at rest.

Run Anytime

Verify their coverage is active, accurate, and adequate before their rental date. Prequalify them to rent your vehicle, then check again the day of to make sure nothing has changed.

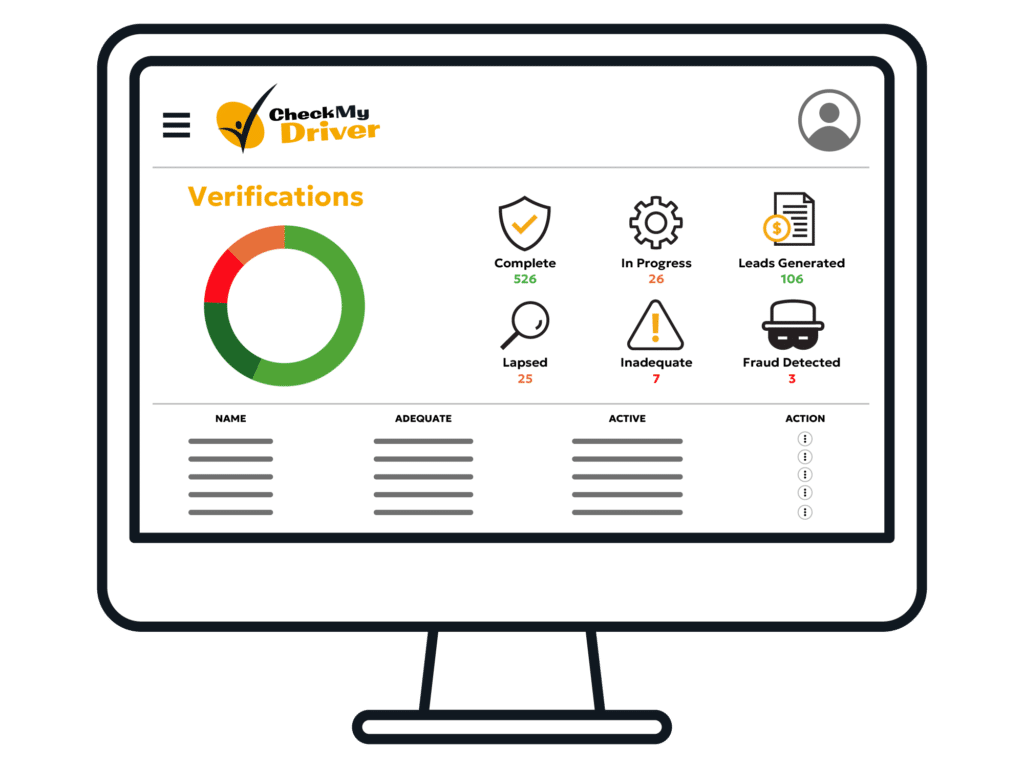

Monitor Coverage

Get notification of cancelation and policy changes in real time through regular checks, giving you transparency sooner than additional interest letters and helping you fix gaps.

Schedule a Demo Today

Learn how CheckMy Driver makes insurance verification and monitoring easy!

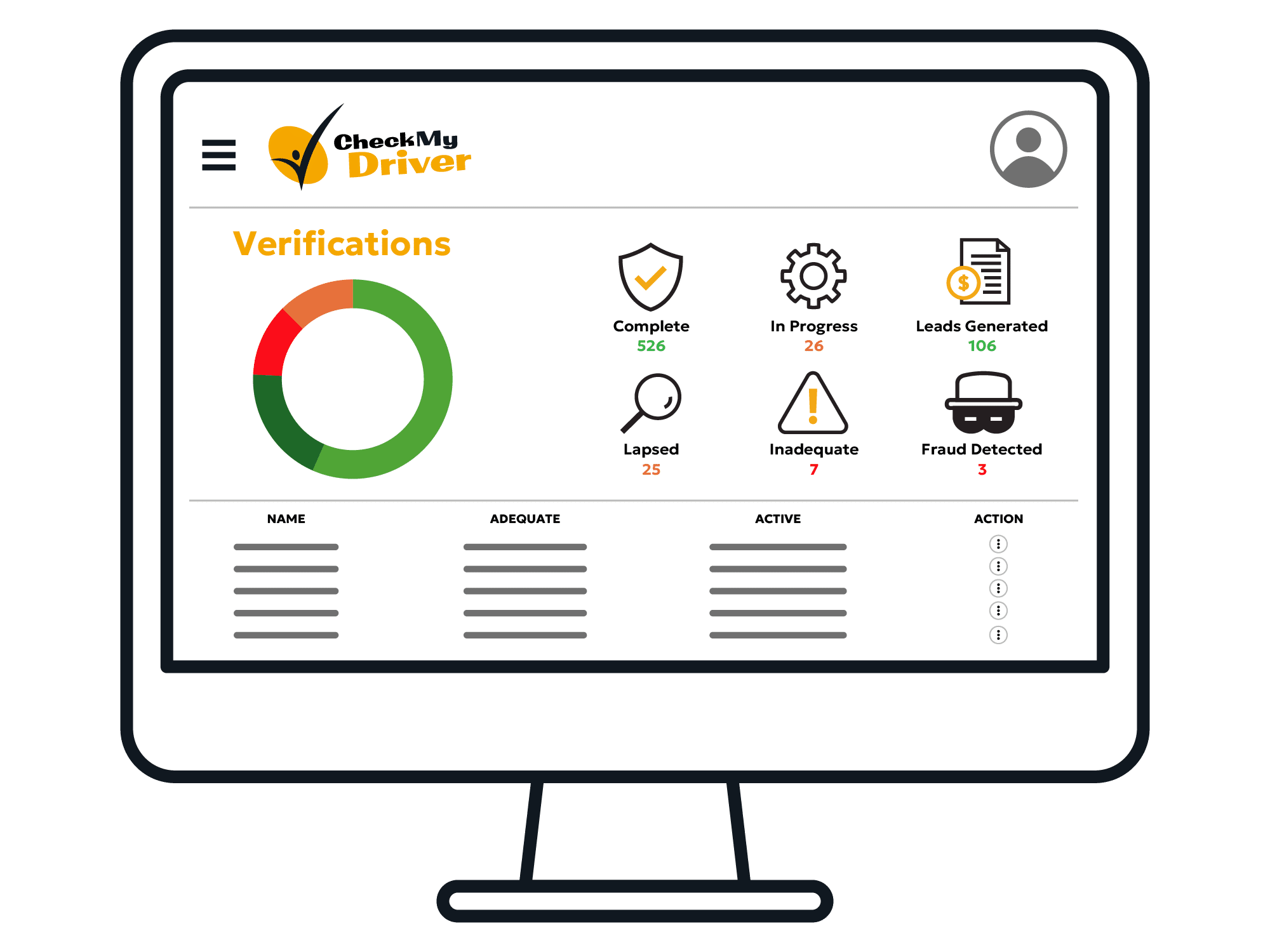

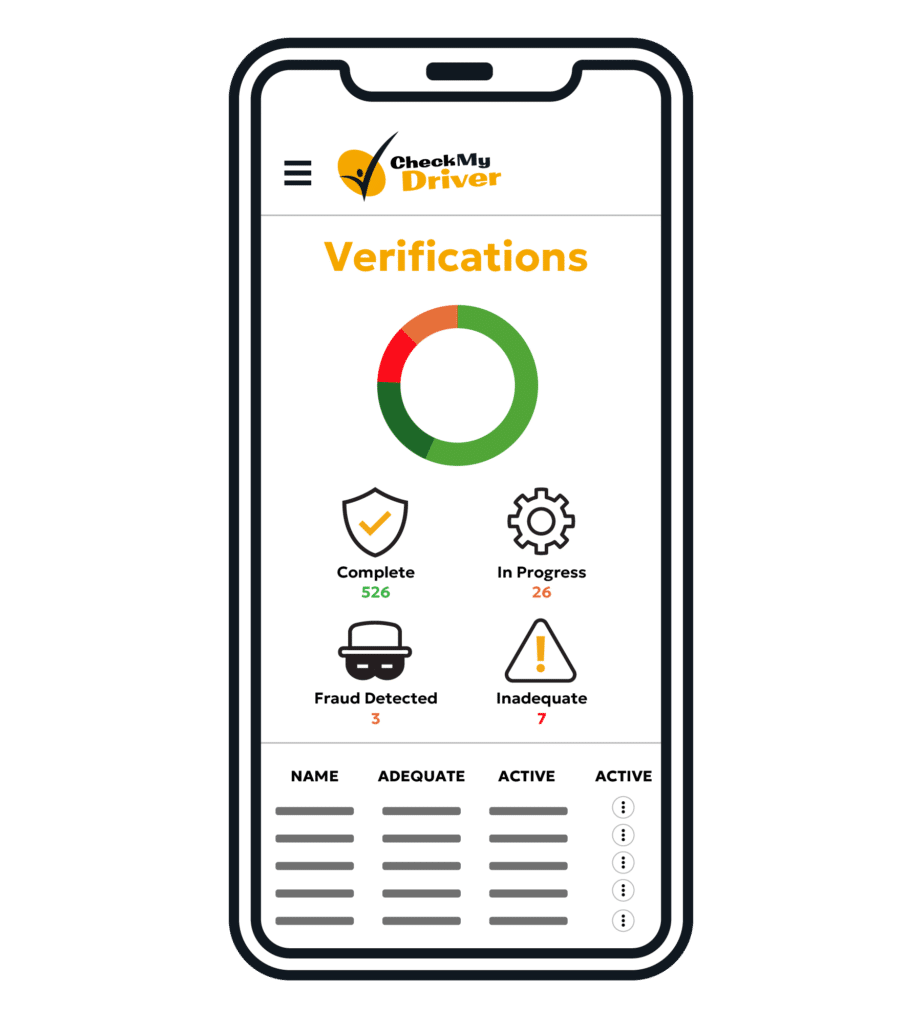

How It Works - As Easy As 1, 2, 3

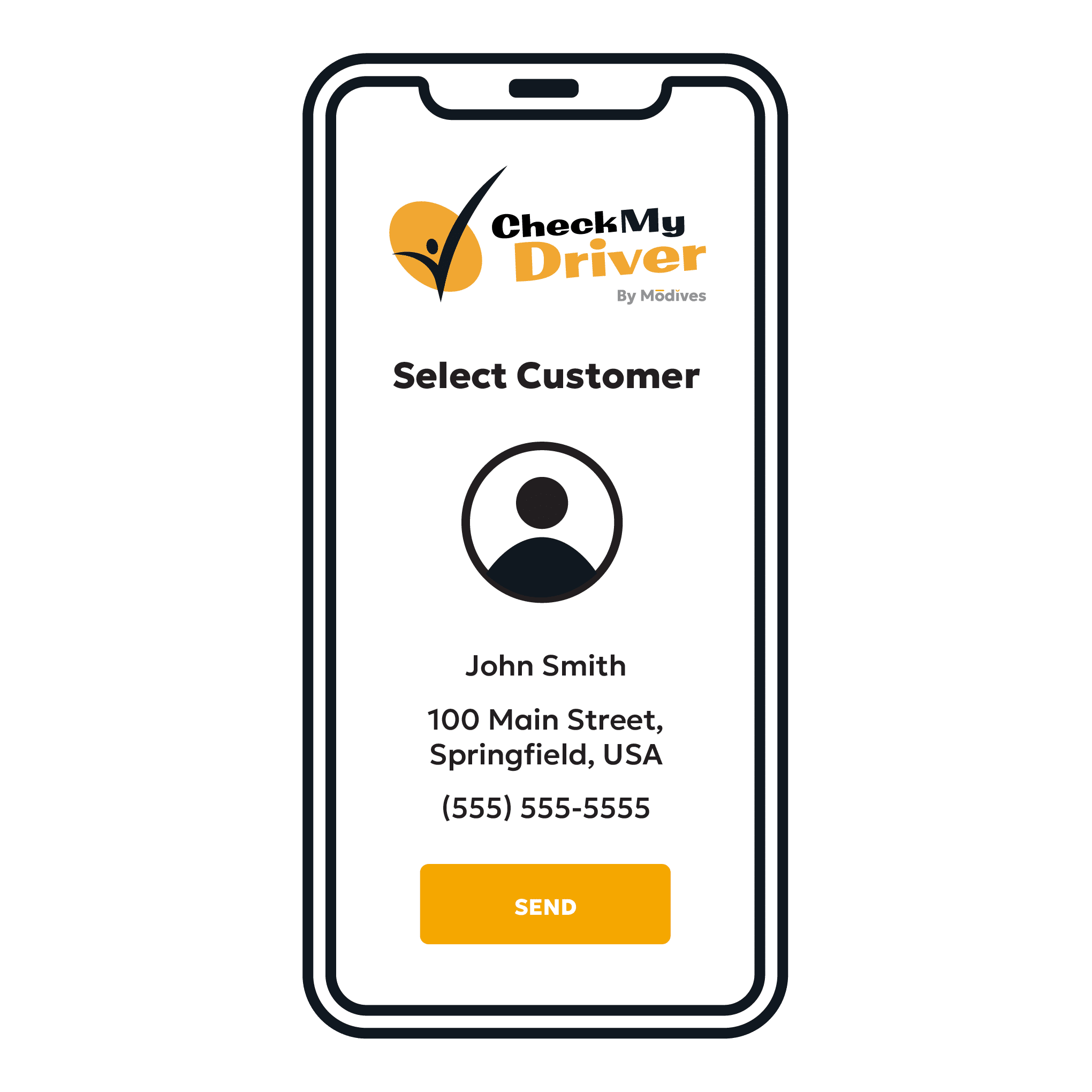

Step 1

Trigger Verification for Your Customer

Step 2

Customer Signs In, Verifies Coverage

Embedded Insurance Options if Coverage Inactive or Inadequate

Step 3

You and Customer Receive Results

Step 4

Policy Monitored for Changes for Loaners and Short-Term Rentals

Features

Detect and avoid fraud with the powerful combination of ID and insurance verification together during your transactions.

CheckMy API

Connect CheckMy Driver directly into your DMS or CRM, delivering key insights into your current tools to supercharge your process.

Adequacy Engine

Put decades of insurance expertise to work analyzing your customers’ coverage data, delivering actionable insights instantly.