In recent years, tech providers have started to introduce integration tools into fragmented industries to streamline previously arduous processes. One popular player in this trend is Plaid, which revolutionized the banking industry by providing a secure way for applications to connect with their customers’ banks.

Alongside the success of Plaid, a lot of tech innovators pursued a similar model across other industries:

- Checkr: Connects with thousands of databases to enable employers to conduct quick, comprehensive background checks

- Finch: Connects with over 200 payroll and HRIS systems to enable tech providers to pull employee data into their applications

- CRS Credit Data API: Connect with major credit bureaus and public records to allow businesses to access credit reports and financial data

You may have heard some tech solutions describe themselves as “Plaid for X,” but what does this really mean? Let’s talk about what it means to be Plaid for insurance, and how to understand the inner workings of modern insurance verification.

Plaid for Insurance: What It Is and Why It Matters

When most people think about Plaid, they think of its success in connecting disjointed systems in a user-friendly, secure application. The Plaid API is a one-stop connection that facilitates communication between software applications and over 12,000 financial institutions.

For instance, let’s say a budgeting app needs access to their customers’ purchase history so they can help visualize their monthly spending. With Plaid’s API, they can prompt the user to securely enter their banking credentials and enable access to their purchase data, all without exposing their banking information to the app.

Before Plaid, if an application wanted to pull a customer’s banking information in real-time, they would have had to create their own integration with each individual bank. They’d also have to collect the data within their own application, potentially opening them up to security risks and creating a need to rely on consumer trust.

The Integration Revolution: Going beyond Fintech

Plaid may have become synonymous with secure, low-touch integrations, but it’s far from the only solution of its kind. As we discussed earlier, lots of players have popped up across other sectors to fill this same need, for a variety of reasons.

Integrating fragmented sectors

For one, many sectors are subject to fragmentation across their organizations. Beyond financial services, other heavily regulated industries like insurance, healthcare, and pharma are often plagued by red tape. While this process is often in place for good reason, creating a safe channel to transmit data from one party to another is essential for avoiding friction when conducting business.

Adapting to a digitized world

Additionally, digitization is accelerating through all areas of life. Consumers are growing accustomed to seamless experiences, from self check-out at the grocery store to getting an Uber straight from your house. Alongside new expectations, undergoing long-winded processes interrupts the customer journey. That’s why sectors that may be slow to adopt modern tech are seeing more companies bridging the gap by pursuing their own digital avenues.

Automating non-core processes

Another major catalyst of innovation in this space is the need for businesses to handle cumbersome but necessary tasks outside of their core business.

For example, let’s say you’re an alcohol delivery business. Your specialization lies in food and beverage retail– connecting consumers and businesses to facilitate alcohol sales. However, since alcohol sales are regulated by the government, you also have to incorporate a function to check customer IDs. By adopting a forensic ID verification system to handle the compliance side, you can spend more time focusing on what you do best.

As we explore integrations within insurance tech, it’s important to understand how all of these benefits are central to the push to streamline insurance verification within property and auto.

The Insurance Verification Tech Stack

When it comes to automating the insurance verification process, unless you are incorporating a solution that specializes in coverage analysis, you need to understand what it’s replacing.

Solutions in this space are designed to replace manual steps that many F&I and leasing offices are very familiar with – collecting a customer’s proof of insurance, calling the carrier to retrieve data from the source, and combing through the documents to compare the information and verify that the customer policy information is active, accurate, and adequate.

Most insurance verification tech substitutes the first two parts of that process, pulling the customer’s insurance information directly from the carrier. But from there, it’s up to the reviewer to read through the documents and compare that to what’s required.

Because the layout of the declaration page can vary by carrier, and most F&I and leasing agents aren’t insurance veterans, this step can take another five minutes per customer to complete.

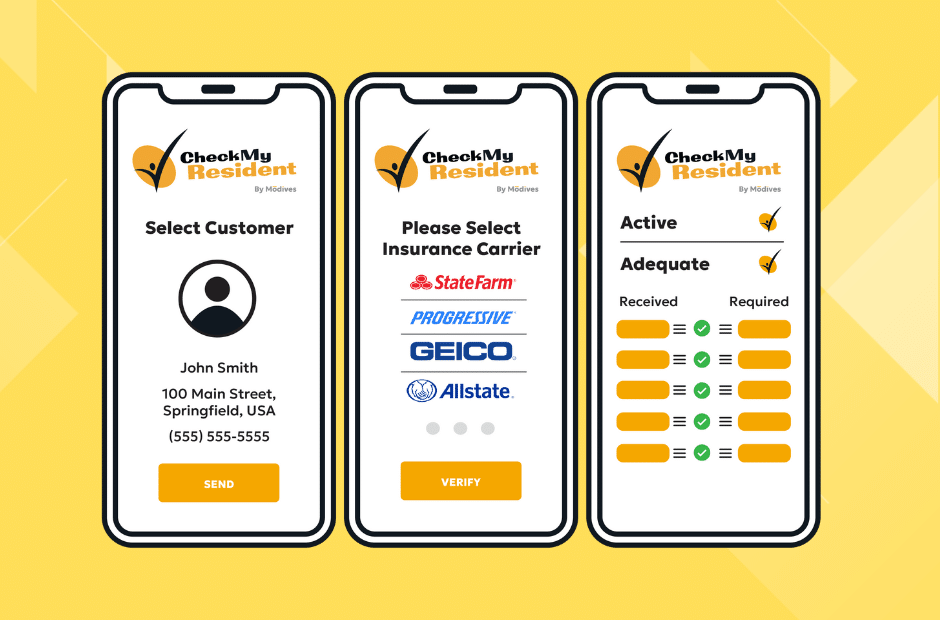

However, CheckMy Driver and CheckMy Resident enable you to automate the whole process, from data retrieval to analysis. On the back end, they integrate directly with hundreds of insurance carriers to access the customer’s policy.

On top of that, the AI-powered engine identifies key information and compares it against what’s required by the organization, returning usable results in seconds. In the end, the customer and office receive an easy-to-read report on whether the policy information is active, accurate, and adequate.

How to Get All-in-One Insurance Verification for Your Business

Currently, Modives’ insurance verification solution serves the auto industry with CheckMy Driver and property with CheckMy Resident. We offer a standalone web app for quick setup or an API for businesses to integrate the software with existing tech.

Connect with our teams to learn more about CheckMy Driver or CheckMy Resident.