CheckMy Driver

For Independent Dealers and BHPH/LHPH

Don’t wait until it’s too late to find out that your customer’s insurance policy is canceled or changed.

CheckMy Driver uses a real-time process to verify your customers' policy on delivery and can keep an eye on their insurance, monitoring it regularly to catch any changes and instantly notify you.

14% of Drivers Are Uninsured

Even if your customer is insured at the time of purchase, they could cancel their policy or have it dropped due to non-payment in just days.

With CheckMy Driver, you won’t have to wait to be notified of a cancelation. Monitoring will pick up on a change in coverage or cancelation up to 60 days before you receive notice, protecting your assets.

Traditional Insurance Verification is Broken

Time

Consuming

You waste time opening additional interest notices, reviewing coverages, and chasing down borrowers.

Ineffective Cancelation

Alerts

Alerts come too late to protect you from losses, and only update you when the policy is canceled, not altered.

Compliance

Violations

The FTC is cracking down on dealerships that don’t protect consumer data, including additional interest letter thirdparty services, delivering massive fines.

Here’s What People Are Saying About Modives

“It saves me, honestly, my week. Once it’s running and connects everyone, I don’t have to waste time spending the rest of my week checking insurance. Instead, I can focus on new business.”

Ciara Fondren, Elite Auto

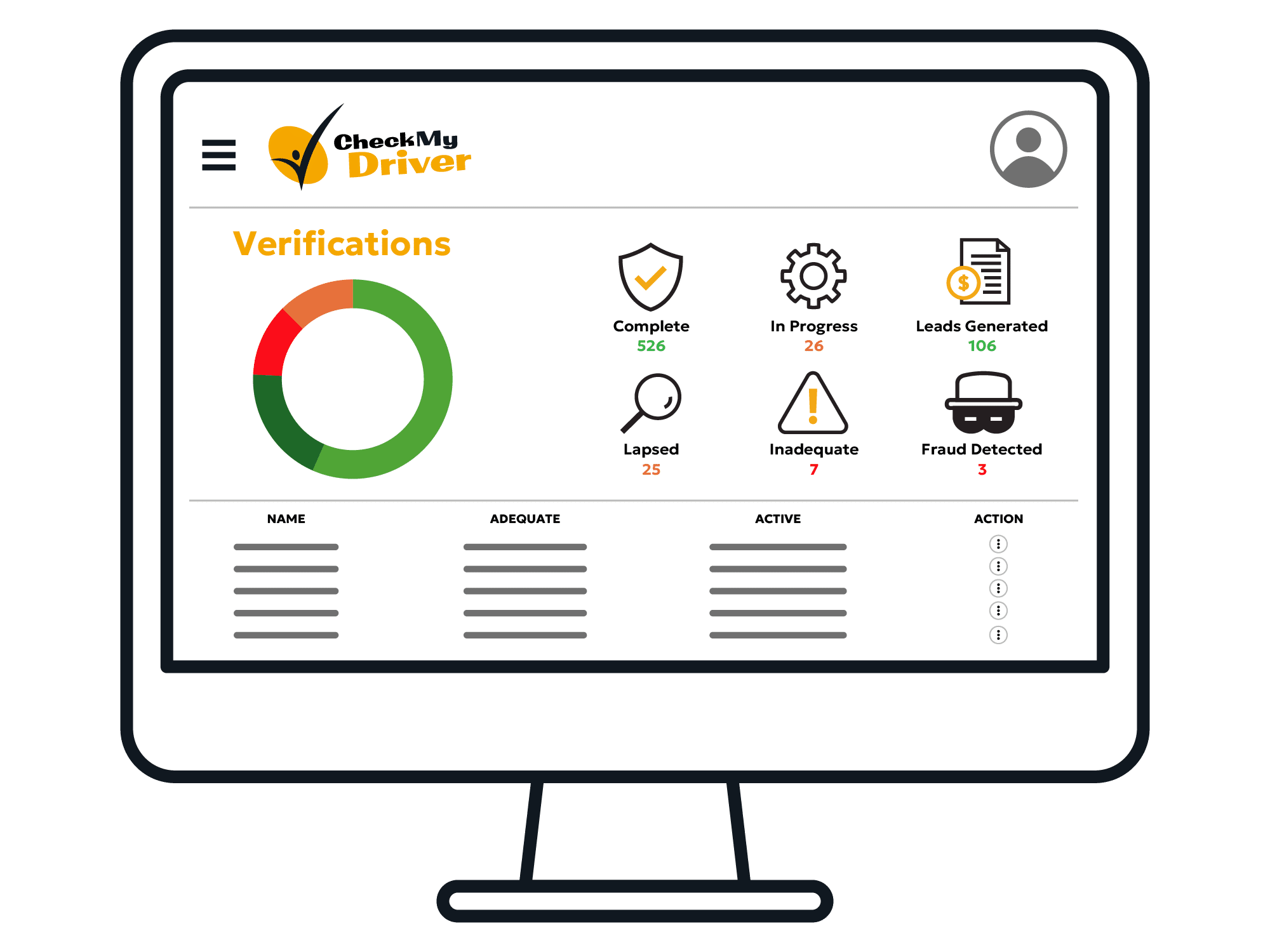

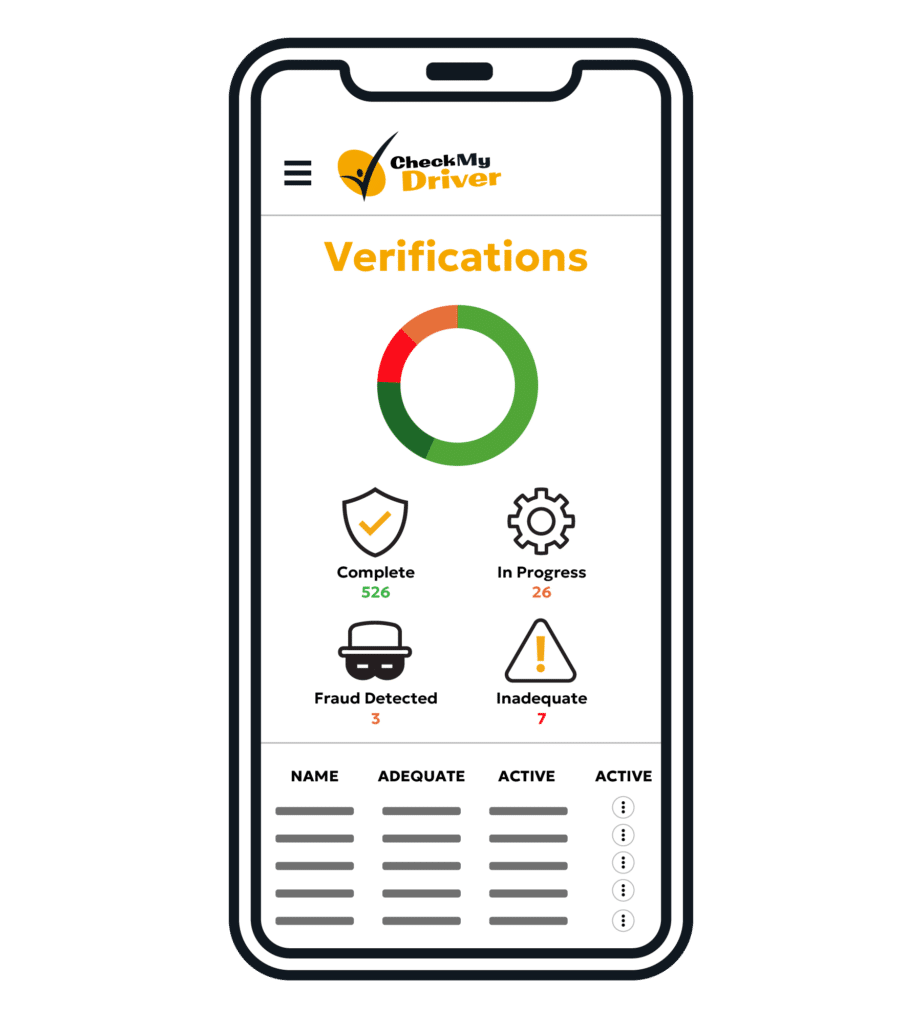

How CheckMy Driver Protects Your Business

Carrier-Confirmed Coverage

CheckMy Driver verifies your customers’ coverage in real time through its simple consumer-driven process.

Monitor Coverage

Get notification of cancelation and policy changes in real time through regular checks, giving you transparency sooner than additional interest letters and helping you fix gaps.

Insurance Expert Analysis

Skip manually reviewing coverages to make sure they meet requirements. Our decades of insurance expertise are at work through our AI-driven adequacy engine to give you actionable and easily interpreted results.

Consumer Data Protection

No need to worry about complying with FTC Safeguards guidelines, CheckMy Driver protects your customers’ data with encryption in transit and at rest.

Easy to Use

Set up your borrower for verification before their loan starts in less than five minutes. We’ll keep an eye on their policy automatically throughout the duration of their loan.

Easy to Use

Set up your borrower for verification before their loan starts in less than five minutes. We’ll keep an eye on their policy automatically throughout the duration of their loan.

Schedule a Demo Today

Learn how CheckMy Driver makes insurance verification and monitoring easy!

‘Additional Interest’ Isn’t Good Enough

Being listed as an ‘additional interest’ on a borrower’s insurance policy doesn’t cover your assets, it leaves you with gaps and more work. CheckMy Resident fixes that problem, automating insurance monitoring and providing the transparency you need.

CheckMy

Driver

- Immediate Notification at Check

- Alerts for All Policy Changes

- Automated Process and Remediation

Additional Interest Notifications

- Notice of Cancelation After 60 Days

- No Notifications for Limit Reduction

- Letters to Open, Problems to Fix

Additional Notifications

- Notice of Cancelation After 60 Days

- No Notifications for Limit Reduction

- Letters to Open, Problems to Fix

How It Works - As Easy As 1, 2, 3

Step 1

You Trigger Verification for Your Customer

Step 2

Renter Signs In, Verifies Coverage

Embedded Insurance Options if Coverage Inactive or Inadequate

Step 3

You and Renter Receive Results

Ongoing

Policy Monitored for Changes, Notifying You of Cancelation or Coverage Options

Features

Detect and avoid fraud with the powerful combination of ID and insurance verification together during your transactions.

Connect CheckMy Driver directly into your DMS or CRM, delivering key insights into your current tools to supercharge your process.

Adequacy Engine

Put decades of insurance expertise to work analyzing your customers’ coverage data, delivering actionable insights instantly.