Download Our eBook on 7 Pitfalls for Property Management

Learn how CheckMy Resident can help you:

- Verify your applicant has active, adequate and accurate coverage

- Find risk mitigation solutions if their insurance doesn’t meet your needs

- Monitor their policy during their lease to get transparency into any changes and their impact on your risk

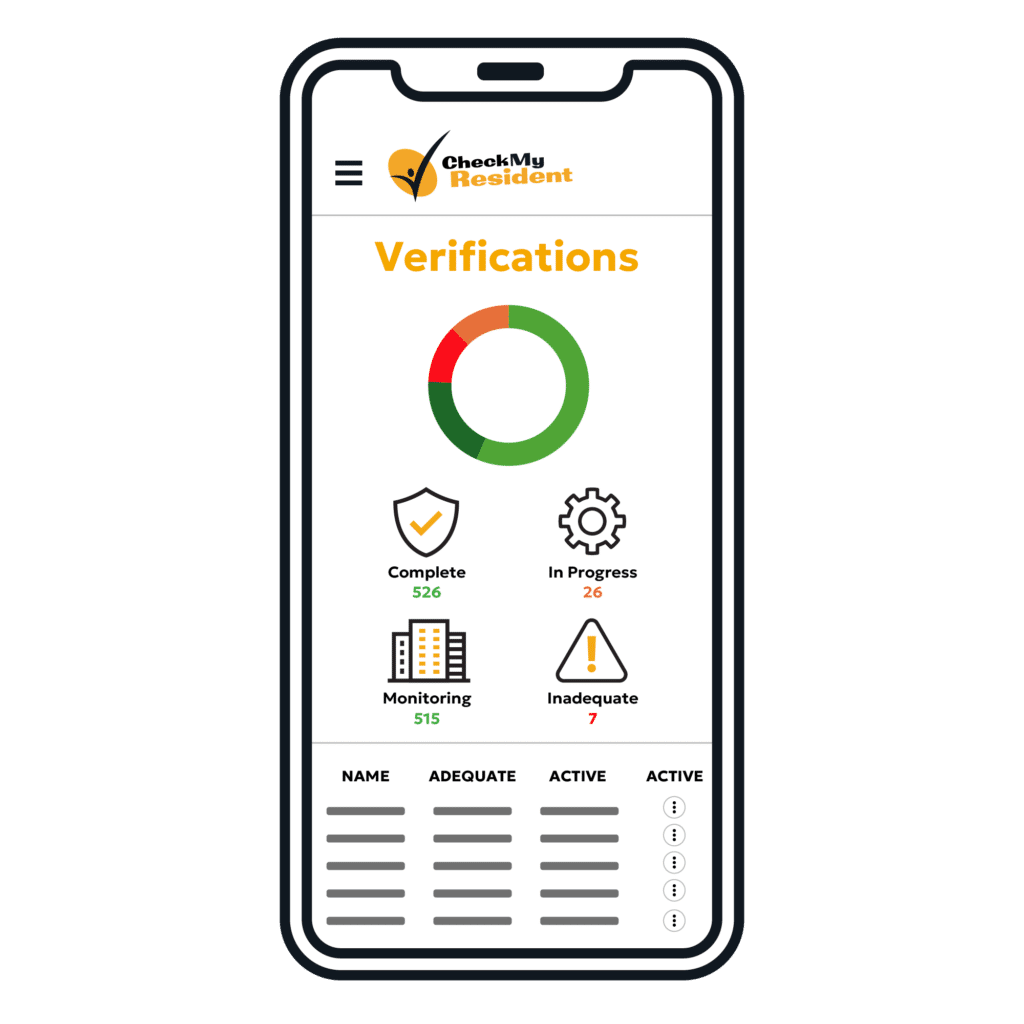

45%

of renters cancel their policies before the end of their lease, with nearly 20% terminated within 180 days of issuance. That means that even if you check their policy at move-in, your business could be at risk without monitoring that it remains active and adequate.

We Fix The Broken Insurance Verification Process

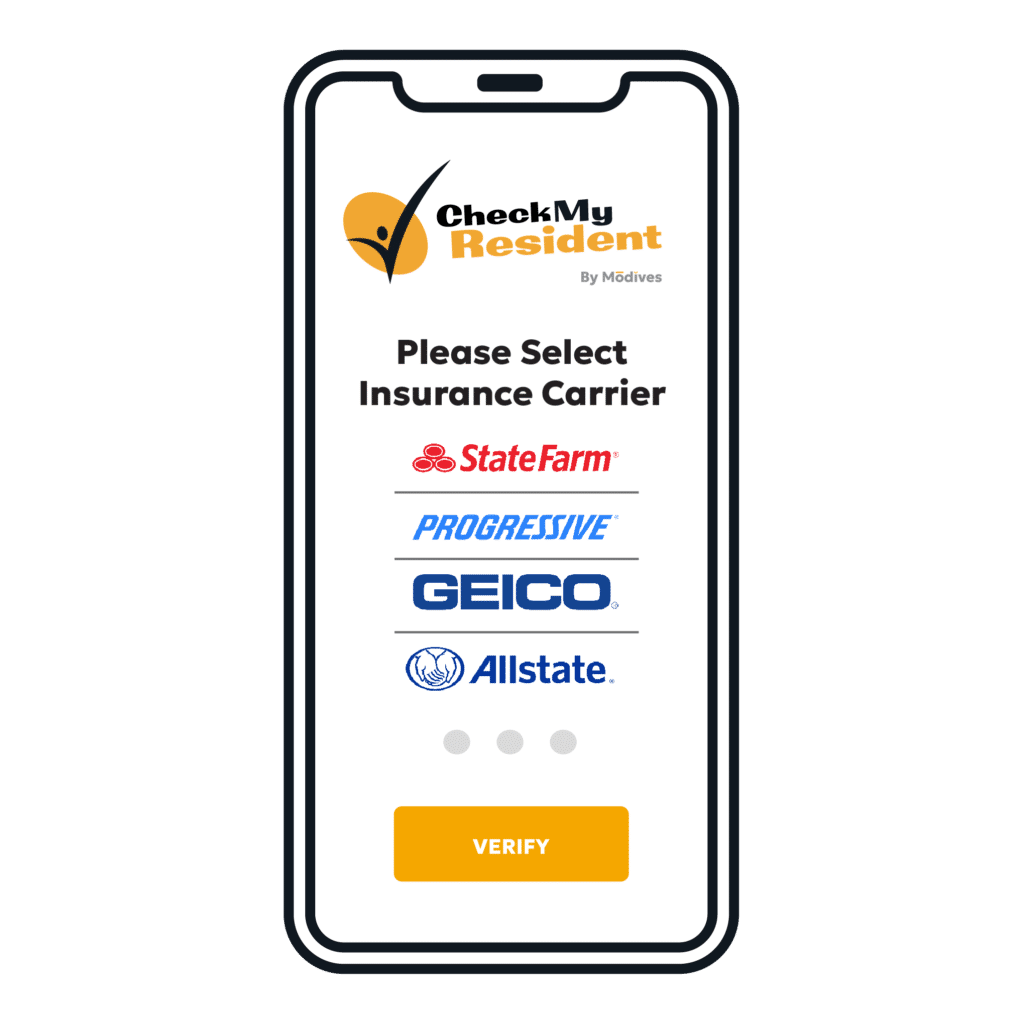

Carrier-Confirmed Coverage

Don’t rely on document uploads that could be outdated or fraudulent. CheckMy Resident verifies your renters’ coverage in real time through a simple consumer-driven process.

Automatic Monitoring

Regular checks that make sure their renters insurance remains in place and unchanged. That means no more opening ‘additional interest’ letters or relying on notifications to following up with tenants.

Embedded Insurance and Remediation

If your renters don’t have coverage or it falls out of compliance, we help them get back on track automatically.

Insurance Expertise

Skip manually reviewing coverages to make sure they meet requirements. Our decades of insurance expertise are at work through our AI-driven adequacy engine to give you actionable and easily interpreted results.

Easy Set-Up

Start verifying and monitoring in minutes through our web-based application, or use CheckMy API to integrate directly into your PMS or CRM.

Ancillary Income

Generate incremental revenue to bolster your business’s bottom line.

Schedule a Demo Today

Learn how CheckMy Resident makes insurance verification and monitoring easy!

‘Additional Interest’ Isn’t Good Enough

Being listed as an ‘additional interest’ on a borrower’s insurance policy doesn’t cover your assets, it leaves you with gaps and more work. CheckMy Resident fixes that problem, automating insurance monitoring and providing the transparency you need.

CheckMy Resident

- Immediate Notification at Check

- Alerts for All Policy Changes

- Automated Process and Remediation

Additional Interest Notifications

- Notice of Cancellation After 60 Days

- No Notifications for Limit Reduction

- Letters to Open, Problems to Fix

How It Works - As Easy As 1, 2, 3

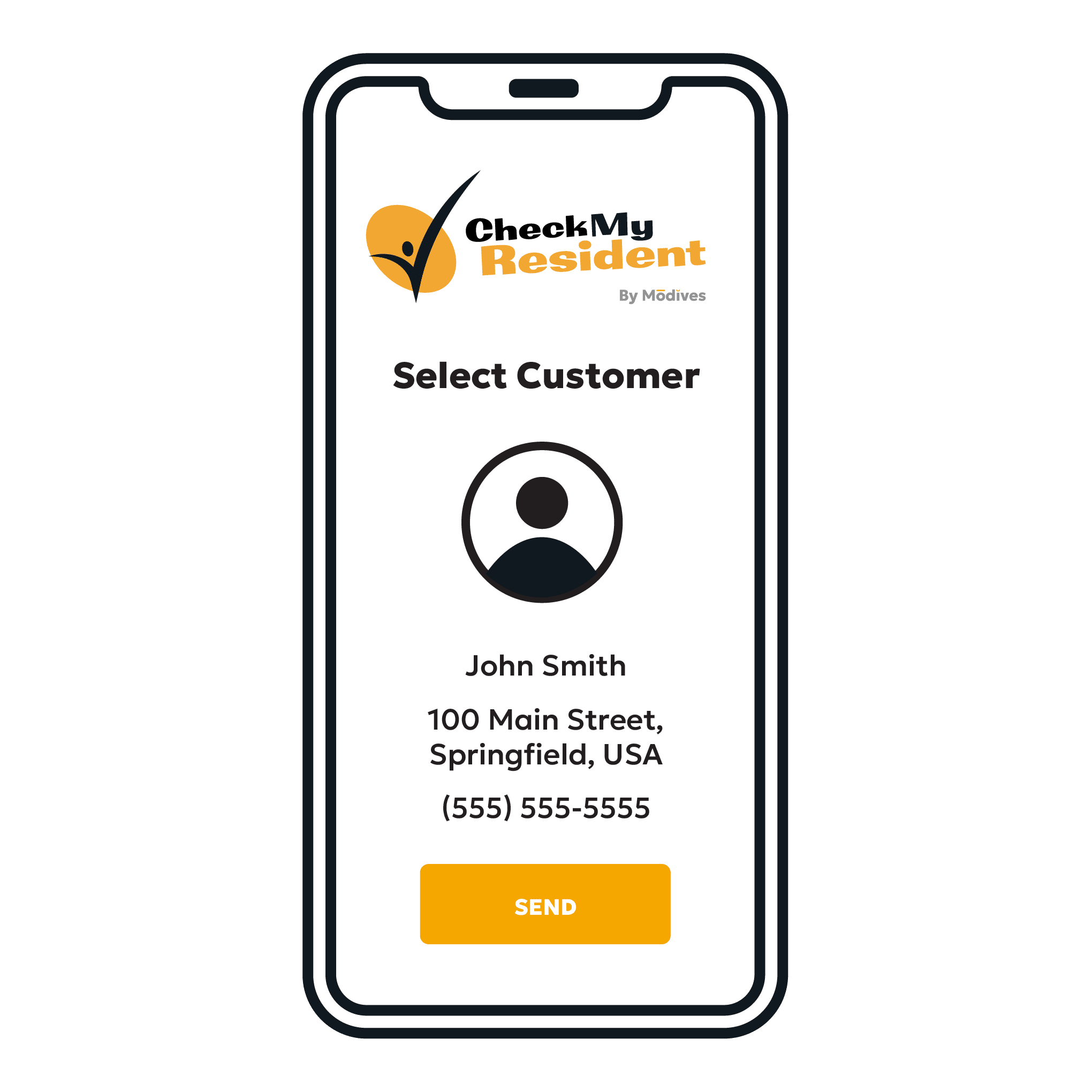

Step 1

You Trigger Verification for Your Resident

Step 2

Resident Signs In, Verifies Coverage

Embedded Insurance Options if Coverage Inactive or Inadequate

Step 3

You and Your Resident Receive Results

Ongoing

Policy Monitored for Changes, Notifying You of New Limits or Cancellation

Reduce Your Risk

Resident negligence drives an average of $1.2 billion in property damages annually, which is why you require renters insurance. But do you know if their coverage is active and adequate?

Two Ways to Get Started with CheckMy Resident

User-Friendly Application

No Tech resources? No problem! Get up and running on our easy-to-use web application in minutes.

Flexible API

Want to pull our verification and monitoring processes into your own systems? Our API can meet your needs.